Different Kinds of Sustainable ETFs to Invest In

Interest in sustainable and ethical investing has grown tremendously in recent years. Today, more people are seeking companies that align with their beliefs and values.

Thanks to this growing interest, companies have started paying more attention to their ESG ratings. That is their score on three key measures; environmental, social, and governance. And now, you can find funds that contain only those companies that have met the ESG criteria. ESG ETFs, also known as sustainable ETFs, are now available for investors looking to make a difference aside from financial gains.

In this article, we look deeper into sustainable ETFs, including the different kinds of sustainable ETFs to invest in. Most importantly, you will find tips to help you choose the right ESG ETF for you:

Source: pionline.com

Contents [show]

What are Sustainable ETFs?

A sustainable exchange-traded fund (ETF) is an investment option or security that includes a variety of companies committed to the ESG criteria. So, instead of investing in just one company’s stock, you invest in numerous companies at once under one basket.

Typically, sustainable ETFs include companies that are invested in reducing their impact on the environment, promoting inclusivity and diversity, and sticking to ethical business/ governance practices. The screening process also excludes any companies whose practices are controversial or unethical.

More recently, ETFs can also seek to be classified as benefit corporations. As such, these funds not only seek to make returns for investors but also generate public benefit, that is, to customers and society at large.

The Different Kinds of Sustainable ETFs

Sustainability is a vast concept, and so not all sustainable ETFs are crafted the same. That said, sustainable ETFs can be broadly classified into two categories:

Single Theme ETFs

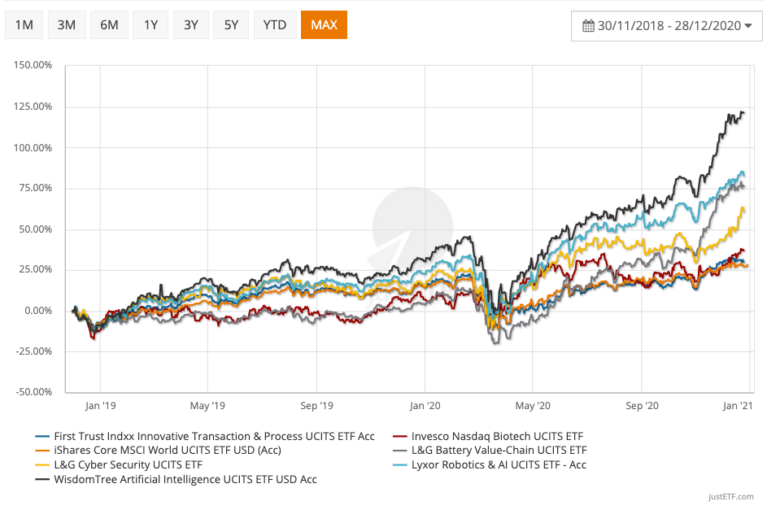

Source: etftrends.com

As the name suggests, a single-theme ETF is a fund that brings together companies with one narrow sustainability focus. For example, an ETF that has companies investing in energy efficiency can be classified as a single-theme ETF. You can find single-theme ETFs in a variety of areas, including carbon footprint minimization, veganism and animal rights, gender inclusivity, female leadership, and so. This kind of ETF is great for investors with only one particular cause they want to support.

Generalist Theme ETFs

Source: monevator.com

While single-theme ETFs sound good at face value, they come with some limitations. While you probably have one issue you currently want to support at the moment, in many cases, people have a spectrum of issues they have an interest in. What this means is, for instance, you may primarily have an interest in reducing your carbon footprint. However, you may also care about promoting energy efficiency or fighting animal suffering to a lesser degree.

In this case, you want to go for generalist ETF, which is a fund that considers a variety of ESG issues and makes investment decisions based on them.

Benefits of Investing in Sustainable ETFs?

There are many benefits to investing in sustainable ETFs. Some of them include:

Moral Benefit

Investing in sustainable ETFs allows you to be part of socially, environmentally, and economically moral companies. This can make you feel good about the impact your investments are making in the world.

Great Returns

With the world increasingly embracing sustainability in business, investing in sustainable ETFs can set you up for potentially high returns. In fact, various studies have actually confirmed that companies committed to sustainability and responsible business tend to be more profitable.

The thinking behind it is that such companies tend to have a long-term outlook and are unlikely to engage in unethical or downright risky practices that could undermine financial performance.

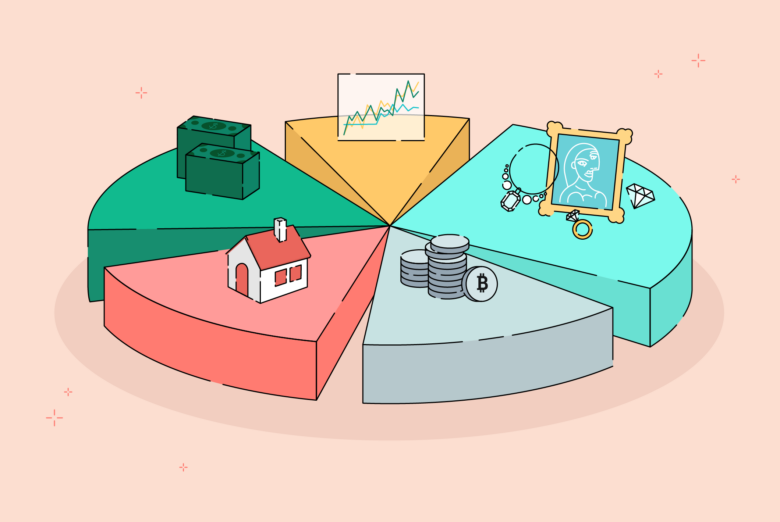

Portfolio Diversification

Another benefit of investing in sustainable ETFs is diversification. ETFs allow you to spread your investment money across many companies, minimizing losses during economic downturns.

Source: kubera.com

Considerations to Make When Choosing Sustainable ETFs

So, are you ready to invest in sustainable funds? Here are some factors to check and keep in mind:

Fees

Like with traditional ETFs, you need to think about fees before opting to invest in sustainable ETFs. After all, the fees can have a significant impact on your overall return on investment. Specifically, you need to consider the transaction fees and expense ratio.

On the one hand, transaction fees refer to the fees that a broker will charge you for buying and selling sustainable ETFs. They can be negligent on the surface but can really add up if you trade often. For this reason, you want to settle on ETFs with lower transaction fees or even commission-free trading.

On the other hand, the expense ratio is the yearly fee that a sustainable ETF provider will charge you for managing the fund. It is expressed as a percentage of the fund’s assets and drawn from its returns. A lower expense ratio implies that you get more of your investment’s returns.

Risk Involved

You want to assess risk before investing in sustainable ETFs. Even though these investments tend to perform better due to emphasizing sustainability, they might have market risk. Moreover, sustainable ETFs might be subject to regulatory risk and liquidity, so be sure to look out for these before putting your money into these investments.

Source: smartasset.com

Your Financial Goals

What are your short-term financial goals? What about long-term ones? Consider them to ensure that your investment in sustainable ETFs aligns with your prospects.

Diversification Level

While sustainable ETFs allow you to invest in a wide range of companies, you want to look more keenly to ensure you invest in a fund that has spread its portfolio far and wide. Go for an ETF with diverse companies from different sectors and industries.

Liquidity

You never know, but you might have to dispose of your assets to get some cash. For this reason, you want to pick sustainable ETFs that are liquid enough to allow you to cash when circumstances demand it.

Source: etfdb.com

Make Returns While Making a Difference by Investing in a

Sustainable ETF

With sustainability picking up steam in the investment world, putting your money in sustainable ETFs is an excellent idea. Besides setting yourself up for handsome returns, your investments will positively impact the world. So, become a conscious investor with sustainable ETFs.